haven't filed taxes in 5 years what do i do

Then you have to prove to the IRS that you dont have the means to pay. If a taxpayer doesnt file his or her tax return to purposely evade taxes then he or she can go to prison.

How To File Taxes If You Haven T Filed In Years Youtube

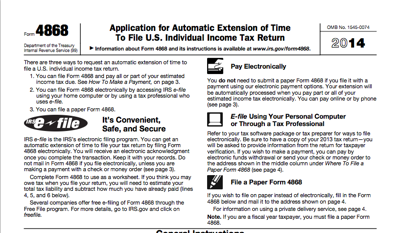

Input 0 or didnt file for your prior-year AGI.

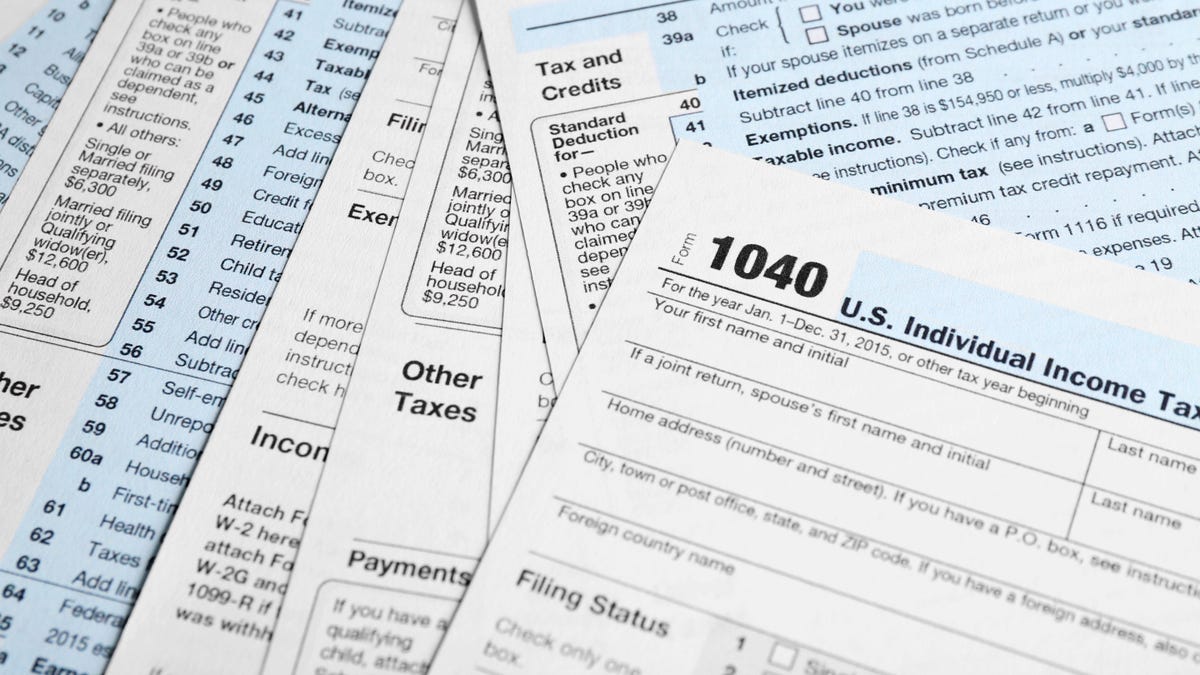

. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Underpayment penalty 05.

If you missed the deadline and did not file for an extension its very important to file your taxes as. Some tax software products offer prior-year preparation but youll have to print. The deadline for claiming refunds on 2016 tax returns is April 15 2020.

Contact the CRA If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good. Failure to file and pay taxes is a serious issue with the IRS which can result in severe penalties said Jodi Cirignano a. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes.

Havent Filed Taxes in 5 Years If You Are Due a Refund Its too late to claim your refund for returns due more than three years ago. Heres what to do if you havent filed taxes in years. The federal tax return filing deadline for tax year 2021 was April 18 2022.

The IRS will prosecute a taxpayer if there is evidence that he or she. However you can still claim your refund for any returns. Then start working your way back to 2014.

Bestselling Learn Guitar on Android. This helps you avoid prosecution for. As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late filing penalty of 5 percent of the tax owing.

If you fail to file your taxes youll be assessed a failure to file penalty. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible. For each month that you do not file.

Most taxpayers are required to file a tax return each year. Failure to file penalty 5 of unpaid tax per month. If youre late on filing youll almost always have to contend with these two penalties.

Then you have to prove to the IRS that you dont have the. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available.

Get Back On Track With The Irs When You Haven T Filed H R Block

What Happens If I Haven T Filed Taxes In Years H R Block

12 Reasons Why Your Tax Refund Is Late Or Missing

What Time Are Taxes Due On April 15 Deerfield Il Patch

Nothing Like The Last Minute Tax Filing Tips For Corporations Inc Com

Calling Procrastinators If You Haven T Filed Your Taxes Yet This Is For You Don T Miss This Timeswv Com

What To Do If You Haven T Filed Your Taxes In Years

Can I Get A Stimulus Check Without Filing Taxes Saverlife

How To File Your Taxes In 5 Simple Steps Ramsey

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Where S My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You Cnet

Taxes Archives Njmoneyhelp Com

Haven T Filed Taxes In Years What You Should Do Youtube

Top 5 Things To Know If You Haven T Filed Your Tax Return Yet

Irs Tax Refund Backlog Delays Returns Especially For Paper Filings

:max_bytes(150000):strip_icc()/GettyImages-1367788813-3e9f601f07874706bca823305a2b4015.jpg)

Taxes What To Do If You Haven T Filed